Contribute to the Movenergy Campaign Crowdfunding

One of the biggest excuses I’ve heard from aspiring entrepreneurs is that they can’t start a business today because they don’t have any money. If only they had $50-100k in seed funding to build the first iteration of the product, they’d be able to a launch a successful startup.

Unfortunately, finding an angel investor that believes in you, your company, and your team isn’t always a walk in the park. Although I recommend bootstrapping for as long as you can to get your startup off the ground, some young companies do require investment to get the ball rolling, particularly if they have a hardware product.

If you’re having trouble connecting with an angel investor in your local area via AngelList, tech incubators/accelerators, or traditional networking, then check out my list of angel investment alternatives below.

1. Equity Crowdfunding

Equity crowdfunding refers to when an entrepreneur will offer shares in their business in exchange for investment, typically on one of these crowdfunding portals. Unlike on Kickstarter, investors will receive ownership in your business.

Equity crowdfunding can be used for startups or established businesses. In the USA, entrepreneurs can raise money from accredited investors nation wide through equity crowdfunding, and, if the entrepreneur’s company resides in one of the 12 states that have enacted intrastate crowdfunding exceptions, he or she can raise money from investors in that state. (DISCLAIMER: Nothing in this post is, or is intended to be, legal advice. The information herein is provided for informational purposes only and you should consult with your attorney before using any of this information).

The states that have enacted intrastate crowdfunding exemptions as of Aug 2014: Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Maine, Maryland, Michigan, Tennessee, Washington, and Wisconsin.

Benefits of equity crowdfunding: You will have access to a number of angel investors who may not reside in your local area. You may experience a shorter financing period (60-90 days) when traditional angel investment can be many months spent finding a good match.

Drawbacks of equity crowdfunding: You may have many investors who have decided to invest smaller amounts rather than one large investor. You may not have as close of a relationship with your angel investor(s) who can sometimes also be a mentor. Unlike Kickstarter, you must give away equity in exchange for financing.

2. Rewards-Based Crowdfunding

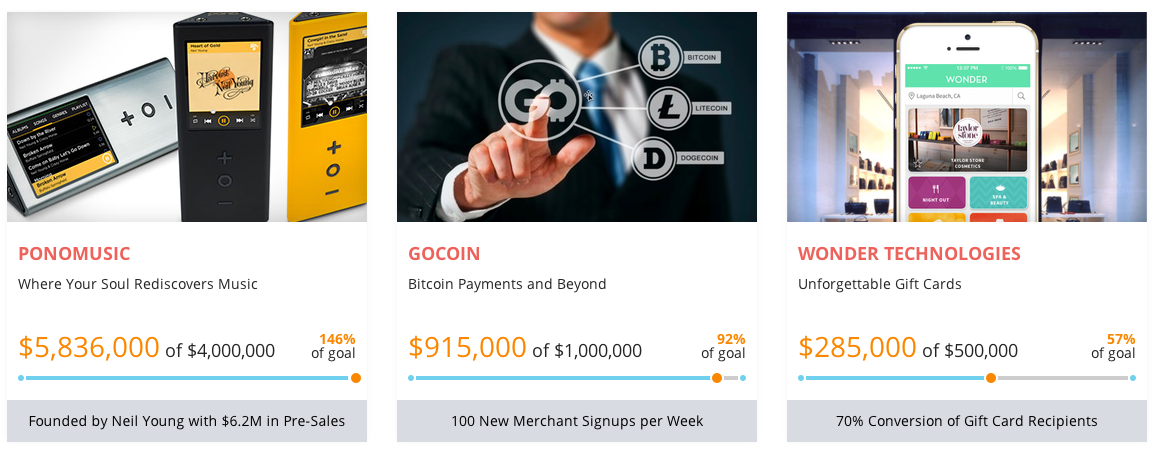

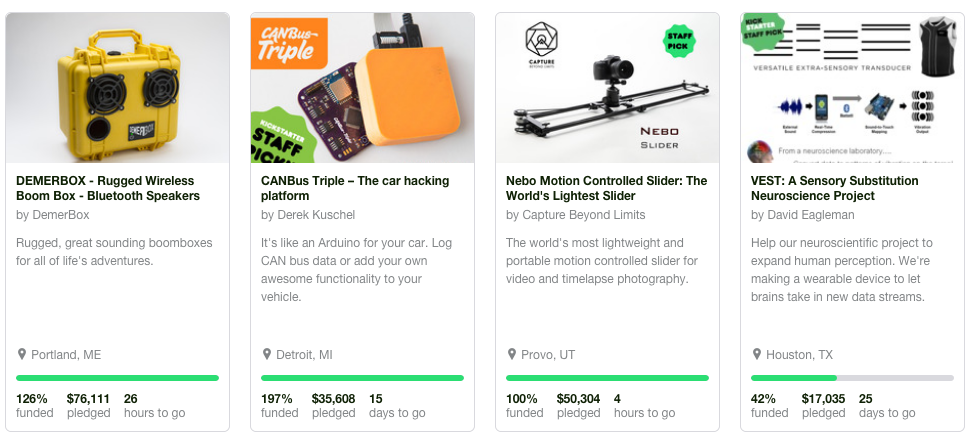

Rewards-based crowdfunding has been one of the most popular types of crowdfunding up until this point. Platforms include Kickstarter, Indiegogo, and others. When you start a rewards-based campaign, you will offer “perks” or “rewards” in exchange for pledges or financing for your project.

Unlike equity crowdfunding, the backers of your project will not have ownership in your product. They typically pledge money to the campaign because they like the individual, the idea, or want to own a copy of the product (pre-order) or one of the other rewards offered.

Up until now, the top 5 most popular categories on Kickstarter have been Gaming, Films & Video, Technology, Design, and Music. Kickstarter is an “all-or-nothing” platform, meaning that if you do not hit your fundraising goal by the end of the campaign period, you will not receive any funds. Indiegogo allows the option of flexible funding, where you can keep the funds you raise, even if you do not hit the goal (note: you must still ship out all the rewards).

Benefits of rewards-based crowdfunding: You can quickly test your proposed project in the open marketplace and see if you can rally support. If you are successful, it often leads to a host of potential new customers, potential news stories, and social media followers. You will also get the funds to begin producing your prototype on a larger scale.

Drawbacks of rewards-based crowdfunding: Most campaigns do not make much profit (see here), as you must create and ship out your rewards to the backers of your campaign, which costs money. You must ask your friend and family to support the campaign in the beginning, to jumpstart the fundraising process, which can sometimes feel “pushy.”

3. Peer to Peer Lending or Debt Crowdfunding

Peer to peer lending is a newer form of financing, where individuals or institutions can invest in loans and earn monthly returns. There are several online peer to peer lending websites that you can use including LendingClub, Prosper, FundingCircle, and UpStart. You can use one of these websites to get a loan to start your business.

For business loans, you can ask for up to $100,000. For personal loans, you can ask for up to $35,000.

Benefits of peer to peer lending: You can get a loan without going through a bank or other financial institution. The entire process is online, making it much simpler, and you can set up an automatic loan repayment schedule online.

Drawbacks of peer to peer lending: Like Mark Cuban says in , starting a business is very risky and the one certainty is paying back that loan you took out. Be sure to have a clear plan for loan repayment and how the money will be used.

4. Traditional Loan with Collateral

The SBA (US small business administration) put together a great guide as to what to expect when applying for a business loan. It’s important to do some shopping around before committing to a bank or institution. A strong business plan, founding team, and credit history are a must. It’s also likely the institution will ask for some form of collateral, should you fail to repay the loan.

Benefits of a traditional bank loan: If doing business with a bank in your local community, they may also be able to recommend other service providers, like attorneys, and introduce you to other business people in the community.

Drawbacks of a traditional bank loan: Again, startups are risky and loan repayment is the one certainty, whether it’s of your own will or forfeiture of your collateral.

5. Friends and Family

Friends and family are the only non-sharks I’ve come across in the business world. These are people who have seen your past performance and may be willing to invest their hard earned dollars in your venture because they believe in you.

Do not take their money lightly. It’s important to treat any family member or friend as any other type of investor and keep them up to date on the financials and progression of your company. In addition, assess the implications of the harm that might be done to your personal relationship with these individuals should your venture fail.

Set realistic expectations for the business’s growth and give clear warnings that you may lose their money should your venture not succeed.

Benefits of family and friends financing round: Much easier to convince family and friends of the value of your business, despite lack of inexperience or credit rating.

Drawbacks of family and friends financing round: You can harm your relationship(s) in the process of trying to launch a venture. Individuals who have no experience in the industry you are going after now have the ability to have more of a say in your company and where it should go.

6. Previous Employer & Industry Leading Companies

I’ve seen this happen where a previous employer is willing to invest in an entrepreneur’s company, due to synergies with the company and that the company has already witnessed the performance of the entrepreneur in the past.

In addition, I’ve seen this happen where a industry leading company may be willing to invest in a startup due to synergies and because the founders have some kind of a prior relationship with the company. This can sometimes lead to an aqui-hire further down the road.

Benefits: You will be selling people who have seen your capabilities in the workplace on the merits of your new business, which makes it easier to establish credibility.

Drawbacks: Unless you present the idea and business properly, your previous employer might claim you worked on the idea under company time, meaning that they own the intellectual property. Also, your previous employer will have a say in the direction of the company.

7. Service-Based Business

For most entrepreneurs, this is an “un-sexy” approach. The sexy approach is to hack together a prototype, get traction, get investment, and grow big.

The alternative is to develop your business part-time, while you are working for an employer or are working as an independent contractor. You can also offer services in addition to the product that you are trying to develop.

For example, if you are trying to create a do-it-yourself ecommerce store builder like Shopify, but don’t have enough users to financially support the company and don’t have investment, you could offer a service where you offer to build people’s websites or ecommerce stores using your software. You would then charge an hourly fee, which would create a revenue stream for the business.

When 37Signals first started (creators of the ruby on rails programming language), they offered website design and development services until their commercial product, Basecamp, generated enough revenue so that they could become a product-focused company. Basecamp is a project management software tool.

Benefits: You will quickly get some revenue into the company which can support the founders and other expenses. If you are good at what you do, you should always be able to find contract jobs.

Drawbacks: You will be dividing your time between helping build other people’s companies and building your own.

8. Credit Cards

Lastly, as a last resort, you can turn to credit cards to finance your business. When watching interviews of famous founders and reading the stories of successful entrepreneurs, the use of credit cards is almost framed as a rite of passage.

Personally, I think that’s complete nonsense and stupidity. Despite the fact they are an easy way to access money, you will pay the highest interest percentage using credit cards. It might seem “cool” to bet everything on your one idea, to the extent where you rack up thousands of dollars of credit card debt, but the only people it’s “cool” for is the company holding your debt, who will come out the real winner.

Many entrepreneurs have multiple failures before they experience “overnight success.” You don’t want to make mistakes that will put you out of the game completely. Racking up credit card debt is a sure way to decrease your chances of success long-term. Don’t do it.

Benefits: Quick money.

Drawbacks: Headache, having to pay it back at high interest rates, and making it harder to capitalize on future opportunities.

Conclusion

I hope this article was helpful and I’d love to hear what company you are starting via comment below. Are you looking for financing for a startup or an established company? Let me know!

The post 8 Best Angel Investment Alternatives appeared first on Crowdfunding Success Tips.